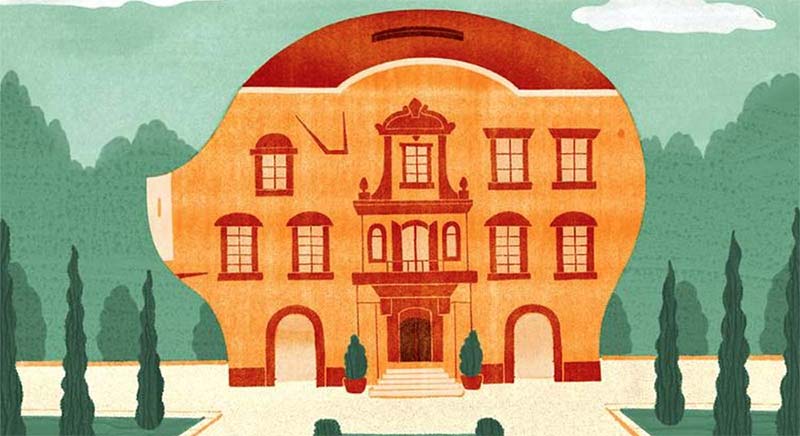

The Wall Street Journal weighs in on the super jumbo loan trend sweeping celebrity real estate, citing Carlyle Financial President Robert Cohan as an industry expert on the massive mortgages that have become the financial tool of choice for high-profile homebuyers. Excerpt below and view the entire article here. What Beyoncé and These Billionaires Have in Common: Massive Mortgages

------

For borrowers who don’t have a strong relationship with a traditional bank, a small network of lenders like private-equity funds and hedge funds are willing to issue debt on megamansions, albeit for a higher interest rate. One instance of a private-equity firm lending on a private mansion is Fortress Investment Group’s loan on Michael Jackson’s Neverland Ranch in the mid-2000s. Mr. Maddux said interest rates on such loans today can be 6% or more if a borrower is considered risky.

Robert Cohan of Carlyle Financial, a mortgage bank based in San Francisco, said private funds evaluate these opportunities on a case-by-case basis, and will often be willing to work with unique situation borrowers like athletes, entrepreneurs and the self-employed.

Full article may be viewed here. What Beyoncé and These Billionaires Have in Common: Massive Mortgages

To speak with Robert or one of our other mortgage experts, contact us here.